Oyu Tolgoi today announced an update on its performance for the fourth quarter and full year 2015.

- Oyu Tolgoi achieved an excellent safety performance for 2015 with an All Injury Frequency Rate of 0.33 per 200,000 hours worked.

- For 2015, Oyu Tolgoi’s second full year of production, the mine operated at record levels.

- Oyu Tolgoi recorded revenue of US$1.6 billion in 2015 on record concentrate sales of 819,800 tonnes reflecting higher concentrate sales volumes partially offset by lower copper and gold prices.

- In Q4’15, Oyu Tolgoi recorded revenue of US$355.6 million on concentrate sales of 236,200 tonnes reflecting lower copper and gold prices combined with lower sales of metal in concentrate.

- Underground pre-start activities are underway in parallel with an update to the feasibility study capital estimate, which is expected to be complete in Q1’16.

- Turquoise Hill continues to expect approval of the updated 2016 feasibility study and notice to proceed decisions by the various boards for underground construction in Q2’16.

- In 2015, copper production of 202,200 tonnes exceeded Turquoise Hill Resources guidance and annual gold production of 653,000 ounces met guidance.

- Oyu Tolgoi is expected to produce 175,000 to 195,000 tonnes of copper and 210,000 to 260,000 ounces of gold in concentrates for 2016.

Safety continued to be a major focus throughout Oyu Tolgoi’s operations and the mine’s management is committed to reducing risk and injury. Oyu Tolgoi achieved an excellent safety performance for 2015 with an All Injury Frequency Rate of 0.33 per 200,000 hours worked.

Oyu Tolgoi President and CEO Andrew Woodley said, “The entire mining industry faced a difficult year in 2015, with significant market pressures and declines in commodity prices. Oyu Tolgoi has responded by maintaining focus on delivering a safe and globally competitive copper business – driving efficiency, reducing costs and improving productivity – proved by our strong performance across all key indicators.

“Our performance extended to our contribution to Mongolia, and the communities we live and work in. Oyu Tolgoi contributed US$315 million in taxes, fees and other payments to the Government of Mongolia, worked with approximately 989 Mongolian suppliers, and continued investment into sustainable development initiatives in the community.”

Revenue of US$1.6 billion in 2015 decreased 5.8 per cent over 2014 reflecting lower copper and gold prices partially offset by higher volumes of copper-gold concentrate sales. Concentrate sales of 2015 of 819,800 tonnes increased 11.7 per cent over 2014 reaching an all-time annual high.

Oyu Tolgoi recorded revenues of US$355.6 million in Q4’15, a 17.6 per cent decrease over Q3’15 reflecting lower copper and gold prices combined with lower metals in concentrate sales. Fourth quarter concentrate sold of 236,200 tonnes increased 4.5 per cent over Q3’15.

For 2015, Oyu Tolgoi’s second full year of production, the mine operated at record levels. Productivity improvements in the concentrator implemented throughout the year led to throughput exceeding nameplate capacity by year end. Copper production for 2015 of 202,200 tonnes exceeded the Turquoise Hill Resources guidance of 175,000 to 195,000 tonnes and annual gold production of 653,000 ounces met 2015 guidance of 600,000 to 700,000 ounces. Compared to 2014 results, 2015 mined production increased 19.3 per cent, concentrator throughput increased 23.9 per cent, concentrate production increased 39.9 per cent, copper production increased 36.3 per cent and gold production increased 10.9 per cent.

For Q4’15, throughput increased 8.5 per cent over Q3’15 reaching an all-time high. Copper production for the quarter increased 2.3 per cent over Q3’15 due to higher volumes offset by lower grades. As a result of mining higher grades from Phase 2 and higher volumes, Q4’15 gold production increased 68.3 per cent over Q3’15.

Operational outlook

Oyu Tolgoi is expected to produce 175,000 to 195,000 tonnes of copper and 210,000 to 260,000 ounces of gold in concentrates for 2016. Open-pit operations are expected to mine in phases 2, 3 and 6 during the year as well as begin stripping for phase 4. In addition, stockpiled ore is anticipated to be processed during the year. The reduction in gold compared to 2015 is expected to result from mining in lower-grade gold areas and processing lower-grade stockpiled ore. The majority of 2016 gold production is expected in the first half of the year. Sales contracts have been signed for approximately 90 per cent of Oyu Tolgoi’s expected 2016 concentrate production.

Turquoise Hill expects Oyu Tolgoi operating cash costs for 2016 to be approximately US$800 million. The reduction compared to 2015 operating cash costs is mainly related to cost reduction initiatives, and additional capitalization of phase 4 stripping costs. Capital expenditures for 2016 on a cash-basis, excluding underground development, are expected to be approximately US$300 million, of which approximately US$280 million relates to sustaining capital. Sustaining capital reflects increased capitalization of phase 4 deferred stripping costs.

For underground development, Turquoise Hill will provide capital guidance for 2016 once a final notice to proceed decision is confirmed.

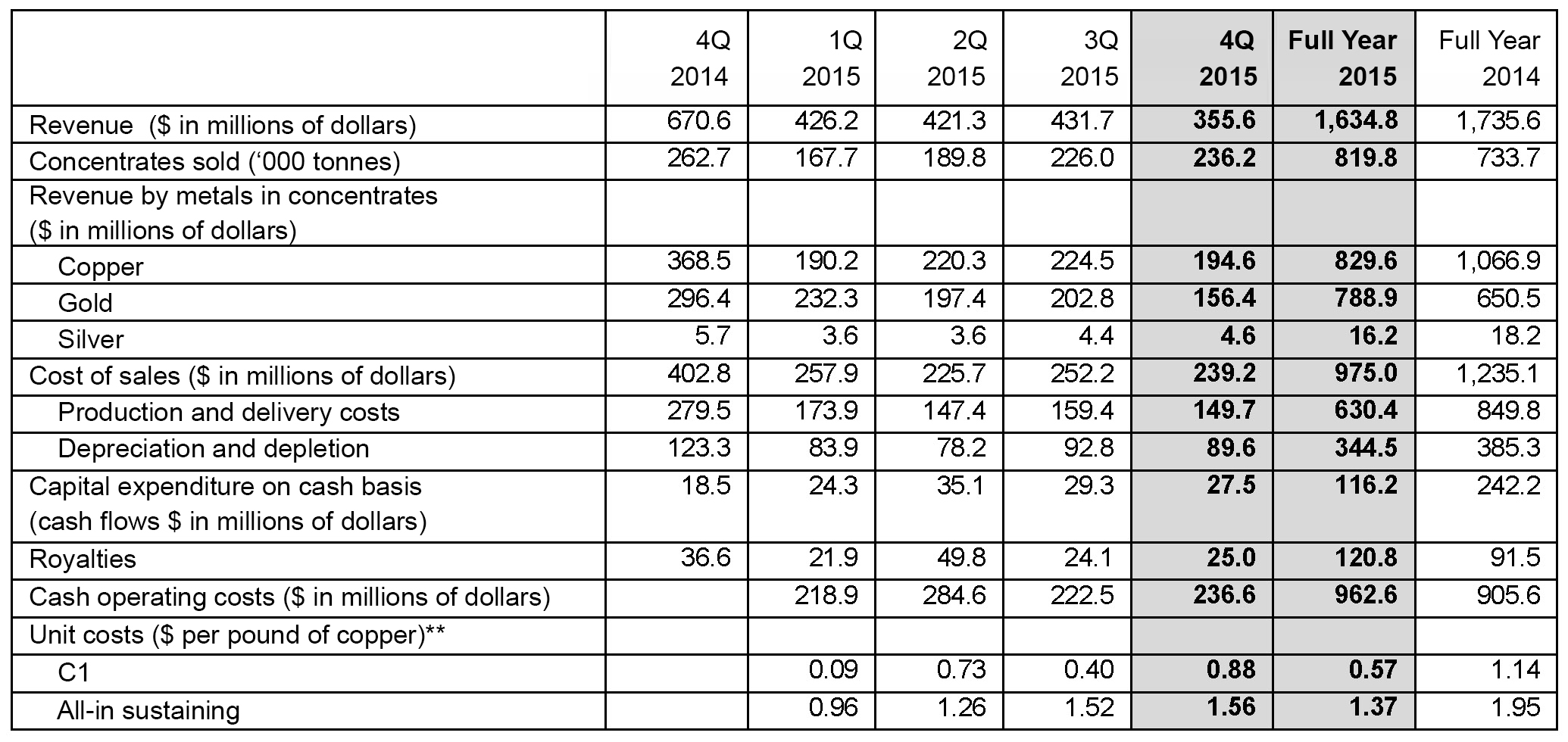

Key financial metrics for 2015 and Q4’15 are as follows:

Notes to the Editor:

- For the full text of the Turquoise Hill announcement, please visit: http://goo.gl/wPZ1Wn

- Beginning on January 1, 2015, Turquoise Hill began preparing its financial statements in accordance with IFRS; all financial metrics included in the below table are prepared on the newly adopted IFRS basis.

- Oyu Tolgoi Key Financial Metrics (as disclosed by Turquoise Hill):

Oyu Tolgoi Key Financial Metrics*

* Beginning on January 1, 2015, Turquoise Hill began preparing its financial statements in accordance with IFRS; all financial metrics included in the above table are prepared on the newly adopted IFRS basis. Any financial information in this MD&A should be reviewed in consultation with the Company‘s consolidated financial statements.

** Please refer to Section 15 – NON-GAAP MEASURES – on page 37 of the MD&A for reconciliation of these metrics, including total cash operating costs, to the financial statements.

Leave a Reply

You must be logged in to post a comment.