Oyu Tolgoi today announced an update on its performance for the second quarter of the fiscal, ending June 30, 2015.

Highlights:

- Oyu Tolgoi achieved a solid safety performance with an All Injury Frequency Rate of 0.22 per 200,000 hours worked for the first half of 2015

- Oyu Tolgoi recorded revenue of US$421.3 million in Q2’15 on sales of 189,800 tonnes of concentrate, a 1.2% reduction over Q1’15, reflecting lower gold prices partially offset by higher concentrate sales

- Concentrate production for Q2’15 increased 64.6% over Q1’15 due to a 20.1% increase in concentrator throughput and higher head grades

- Concentrate production and throughput in Q2’15 were the best Oyu Tolgoi has experienced since operations began

- Copper and gold in concentrates for Q2’15 increased 64.6% and 176.7% respectively over Q1’15

- Oyu Tolgoi began accessing higher-grade material in Q2’15 and mining and processing of higher-grade ore is expected to continue into the second half of 2015

- Turquoise Hill Resources continues to expect Oyu Tolgoi to produce 175,000 to 195,000 tonnes of copper and 600,000 to 700,000 ounces of gold in concentrates in 2015

- On July 9, 2015, Oyu Tolgoi marked the second anniversary of its first shipment of concentrate

Safety continues to be a major focus throughout Oyu Tolgoi’s operations and the mine’s management is committed to reducing risk and injury. Oyu Tolgoi achieved a solid safety performance with an All Injury Frequency Rate of 0.22 per 200,000 hours worked for the first half of 2015.

Revenue in Q2’15 decreased by 1.2 per cent over Q1’15. Lower revenues reflect a fall in gold prices, partially offset by higher volumes of copper-gold concentrate sales. The Q2’15 mix of revenue by metals is the result of inventory with lower contained gold drawn down during the quarter from concentrate produced in Q1’15. Gross margin at 46.4 per cent for the quarter increased from 39.5 per cent in Q1’15, due to the combined effect of higher overall volumes sold and cost improvements, as Oyu Tolgoi continued to optimize operations, which offset the impact of lower gold sales.

Andrew Woodley, President and CEO of Oyu Tolgoi, said: “Alongside a solid safety performance – our key measure of success – we achieved record production in Q2’15. However, global market conditions remained challenging, underscoring the need for us to maintain our focus on optimising cost and improving productivity to ensure we are globally competitive as a business. This is a key imperative as we progress on the important and complex task of developing the underground mine.”

Oyu Tolgoi began accessing higher-grade material in Q2’15. Concentrate production for Q2’15, the highest Oyu Tolgoi has seen since operations commenced, increased 64.6 per cent over Q1’15 due to a 20.1 per cent increase in concentrator throughput and higher head grades. Throughput for Q2’15 was the best Oyu Tolgoi has experienced since operations began. Copper and gold in concentrates increased 64.6 per cent and 176.7 per cent respectively over Q1’15.

Oyu Tolgoi Underground Development

Next steps toward the underground development include updating and receiving approval of the underground Feasibility Study and completing the approximate US$4 billion in project financing.

Turquoise Hill continues to expect signing of project financing by the end of 2015. The 2015 Oyu Tolgoi Feasibility Study, which was submitted to the Mongolian Minerals Council (the MMC) in March 2015, has been tentatively accepted pending an update of schedules and alignment with the Underground Plan. This update is due to be resubmitted to the MMC in September 2015.

Ahead of final approval of the project by the Turquoise Hill, Rio Tinto and Oyu Tolgoi boards, an update to the capital estimate will be completed in parallel with other pre-start activities. The preferred engineering, procurement and construction management contractor has been engaged to complete this work along with some critical path detailed engineering.

Underground development prior to August 2013 suspension

Prior to the suspension in August 2013, underground lateral development at Hugo North had advanced approximately 16 kilometres off Shaft #1. Sinking of Shaft #2, the primary operations access and initial production hoisting shaft, had reached a depth of 1,168 metres below surface, 91 per cent of its final depth of 1,284 metres. The 96 metre-high Shaft #2 concrete headframe has been constructed. Sinking of Shaft #5, a dedicated exhaust ventilation shaft, had reached a depth of 208 metres, 17 per cent of its final depth of 1,174 metres. Surface facilities, including offices, mine dry, and workshop, are in place to support initial pre-production development and construction.

Care and maintenance activities have continued for Shaft #1, facilities and mobile equipment. Ground remediation work is underway and execution readiness activities have commenced in preparation for restarting underground development.

Operational outlook

A planned concentrator shutdown at Oyu Tolgoi was successfully completed in July 2015. Initial assessment of the improvement projects completed appears positive.

Production of higher-grade ore is expected to continue into the second half of 2015. Oyu Tolgoi’s metal production, especially gold, is strongly dependent on the proportion of ore treated from the high-grade zone. During the second half of the year, copper production is expected to be higher than the first half, while gold production is expected to moderate as grades begin to decline in the later part of Q3’15. Turquoise Hill continues to expect Oyu Tolgoi to produce 175,000 to 195,000 tonnes of copper and 600,000 to 700,000 ounces of gold in concentrates in 2015.

Sales contracts have been signed for 100 per cent of Oyu Tolgoi’s expected 2015 concentrate production.

Notes to the editor:

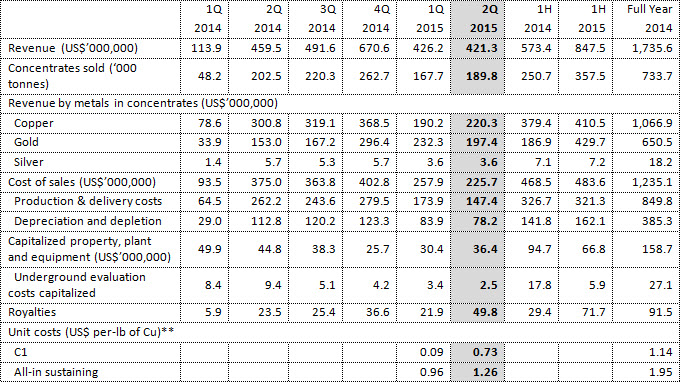

- Oyu Tolgoi Key Financial Metrics* (as disclosed by Turquoise Hill):

* Beginning on January 1, 2015, Turquoise Hill began preparing its financial statements in accordance with IFRS; all financial metrics included in the below table are prepared on the newly adopted IFRS basis.

* Beginning on January 1, 2015, Turquoise Hill began preparing its financial statements in accordance with IFRS; all financial metrics included in the below table are prepared on the newly adopted IFRS basis.

** Please refer to NON-GAAP MEASURES in the Turquoise Hill Resources press release for reconciliation of these metrics, including total cash operating costs, to the financial statements.

For the full text of the Turquoise Hill announcement, please visit: http://goo.gl/1sRBYu